will the salt tax be repealed

The Tax Policy Center found that only 3 of middle-income households would pay. You cannot talk about Bidens infrastructure plan without anticipating a SALT repeal he says.

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

11 rows The TCJA also repealed the Pease limitation for tax years 2018 through 2025.

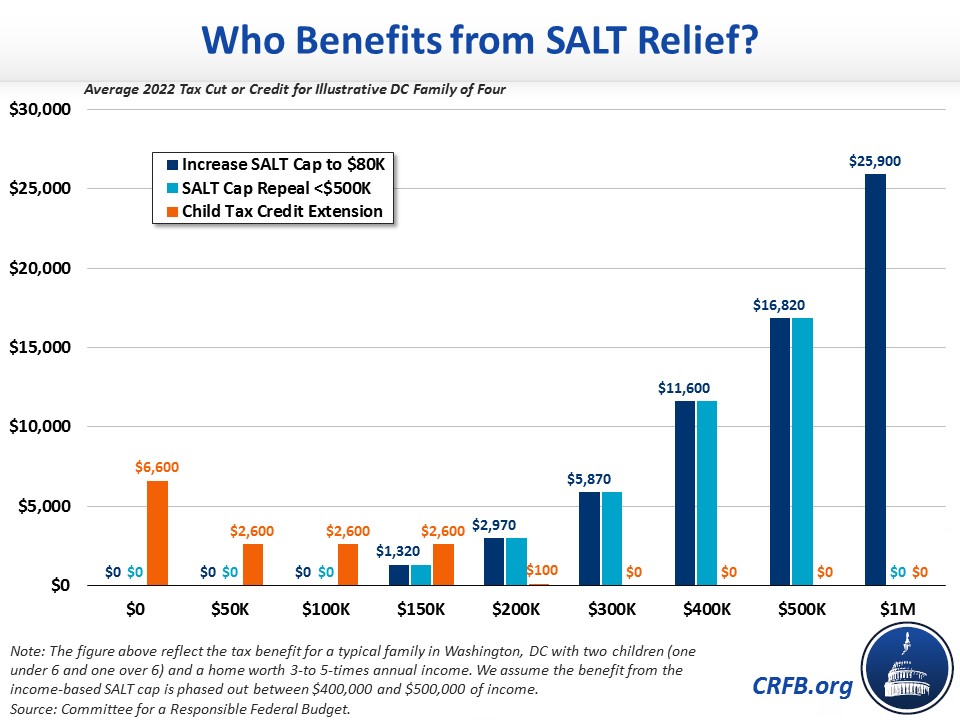

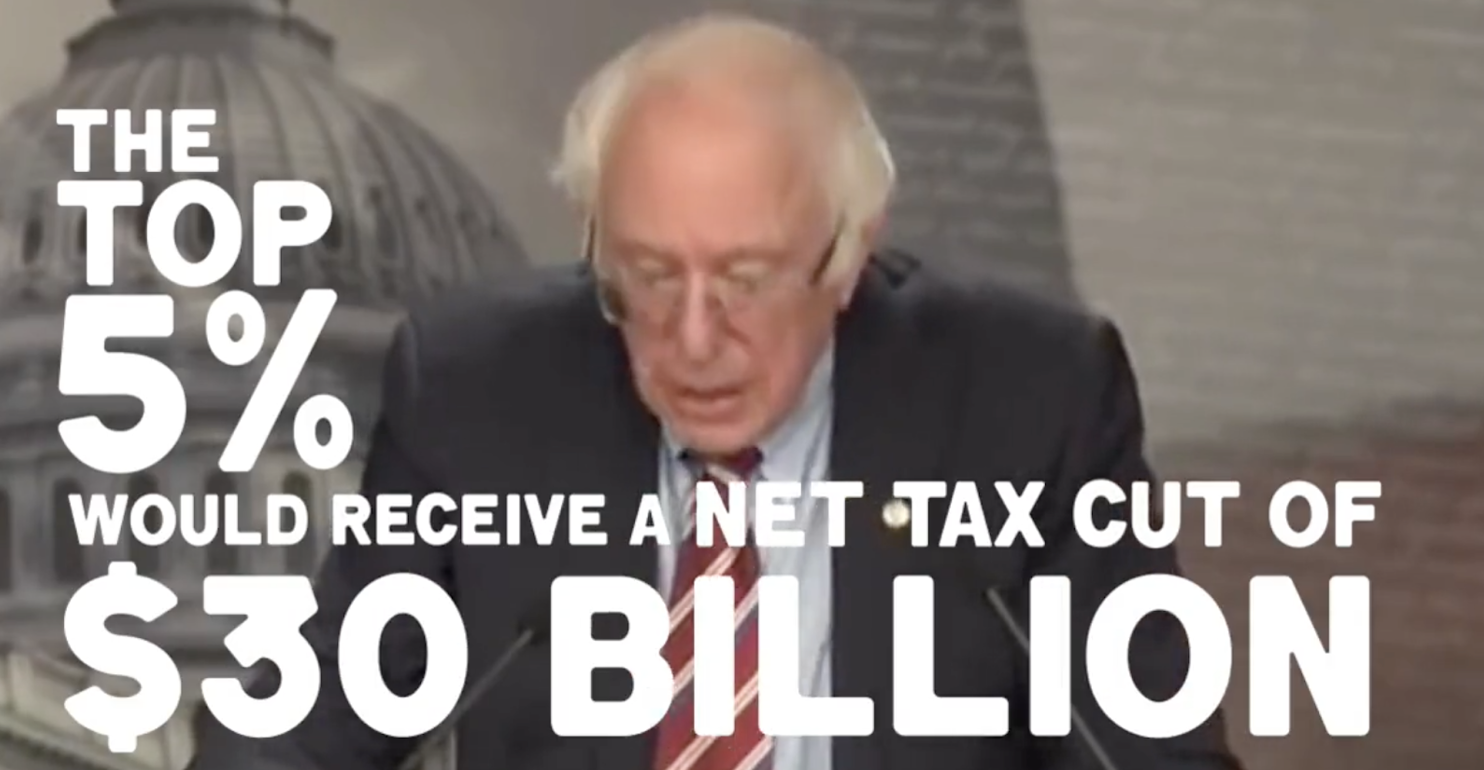

. The SALT tax deduction is. In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep. Households making 1 million or more a year would receive half the benefit of repealing the 10000 federal cap on the state and local tax SALT deduction a study by the.

The nonpartisan Tax Policy Center found that if the SALT cap were to be repealed entirely 70 percent of the benefits would go to people with annual incomes above 500000. Joe Manchin W-Va has been averse to changing any cap on SALT deductions calling them a tax loophole in a statement following the announcement of the. Three House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT.

According to a committee aide a proposal on the table would repeal the 10000 cap for the 2021 through 2025 tax years. It would then be reinstated for five years after that. Repealing the SALT cap in 2021 would reduce federal income tax liability.

D emocratic leadership outlined plans Monday to bypass GOP filibusters to alter the cap on deductions for state and local taxes paid a tax break largely for the wealthy. When SALT is repealed the taxes will be going. That figure dropped to 21 billion in 2020.

Itemizers facing high marginal tax rates with high state and local taxes would see the greatest impacts. Analyses found that repealing the cap would disproportionately benefit the wealthy. The United States Supreme Court rejected New Jersey and other states requests to restore the full income tax deduction for state and local taxes.

The lawmakers have asked. As alternatives to a. Senate Democrats say a proposal to raise the cap on state and local tax SALT deductions a top priority of Senate Majority Leader Charles Schumer D-NY is likely to be cut.

Between 2022 and 2025 the cost of repealing the cap would be 380 billion according to the Tax Foundation. The SALT deduction benefits only a shrinking minority of taxpayers. Finally the TCJA.

After fighting to repeal the 10000 limit on the federal deduction for state and local taxes known as SALT a group of House Democrats say they will still vote for the partys.

High Income Households Would Benefit Most From Repeal Of The Salt Deduction Cap Tax Policy Center

Suozzi Pushes For Salt Cap Repeal In Infrastructure Plan

Online Counties Call For Repeal Of Salt Cap

U S House Passes Legislation To Repeal Salt Deduction Cap For Two Years Focus Turns To Senate Efforts

How A Change To The Salt Cap Would Affect Taxpayers By State Bond Buyer

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

The Retired Investor Will Salt Be Repealed Iberkshires Com The Berkshires Online Guide To Events News And Berkshire County Community Information

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

Democrats Salt Headache Hangs Over Budget Reconciliation Bill Roll Call

This Bill Could Give You A 60 000 Tax Deduction

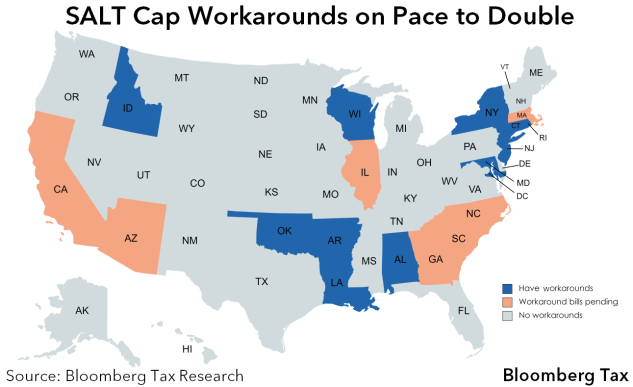

Salt Workarounds Spread To More States As Democrats Seek Repeal

Liberal Democrats Push To Repeal Salt Tax Cap Will Only Benefit Wealthy Washington Times

Wealthy Democrat Donors Likely To Benefit From Democrats Repeal Of Salt Cap Fox Business

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

Salt Cap Repeal Below 500k Still Costly And Regressive Committee For A Responsible Federal Budget

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Why A 10 000 Tax Deduction Could Hold Up Trillions In Stimulus Funds The New York Times

Democrats Say Tax The Rich But Mean Tax Breaks For The Rich Ways And Means Republicans

/cdn.vox-cdn.com/uploads/chorus_image/image/57880159/GettyImages_452873424.0.jpg)

Tax Bill Salt Deduction Repeal Is Another Blow For Blue State Wealth Curbed